Employment market update: April 2020

National Update

National employment figures released this week by the Australian Bureau of Statistics (ABS) showed a 1% rise in unemployment, from 5.2% in March to 6.2% in April.

Total employment fell by a devastating 594,300 persons last month but this was better than what many had predicted.

However these figures don’t reflect the full extent of the damage caused by the pandemic shutdowns.

Why? Because the figures only account for the period between March 29 to April 11. The full toll on unemployment will likely play out over the next few months or year.

Also, the data doesn’t reflect the hundred of thousands of people who stopped looking for work and dropped out of the employment market altogether.

“The large drop in employment did not translate into a similar-sized rise in the number of unemployed people because around 489,800 people left the labour force,” said ABS head of labour statistics Bjorn Jarvis.

It is assumed that these former job seekers had been discouraged to look for work given the current economic and market conditions or have been forced out due to other responsibilities such as homeschooling or caring roles at home.

As these people are no longer looking for work they are not counted in the official unemployment rate. If they were still seeking employment those 490,000 people would top up the employment rate to 9.6% rather than 6.2%.

Furthermore, the unemployment rate has been kept low due to the Governments 130 billion JobKeeker subsidy, that keeps employers attached to their employees. More than 6 million workers are currently on JobKeeper meaning the unemployment rate could increase significantly when the scheme expires in September.

The number of “monthly hours worked” is a better indication of the employment markets true standing. The latest figures show working hours fell by 163.9 million hours – the largest decline previously recorded was 36 million hours in 2007.

The decline in working hours showed women were disproportionately affected experiencing an 11.5% drop in working hours compared with 7.5% for men.

The April data also showed that young Australia’s have huge hit, with the youth unemployment double the overall rate at 13.8% up from the 11.5% figures in March.

Treasury estimates that 1.5 million Australians will be out of work during the first half of 2020. (Originally Supplied: Treasury) Source: abc.com.au

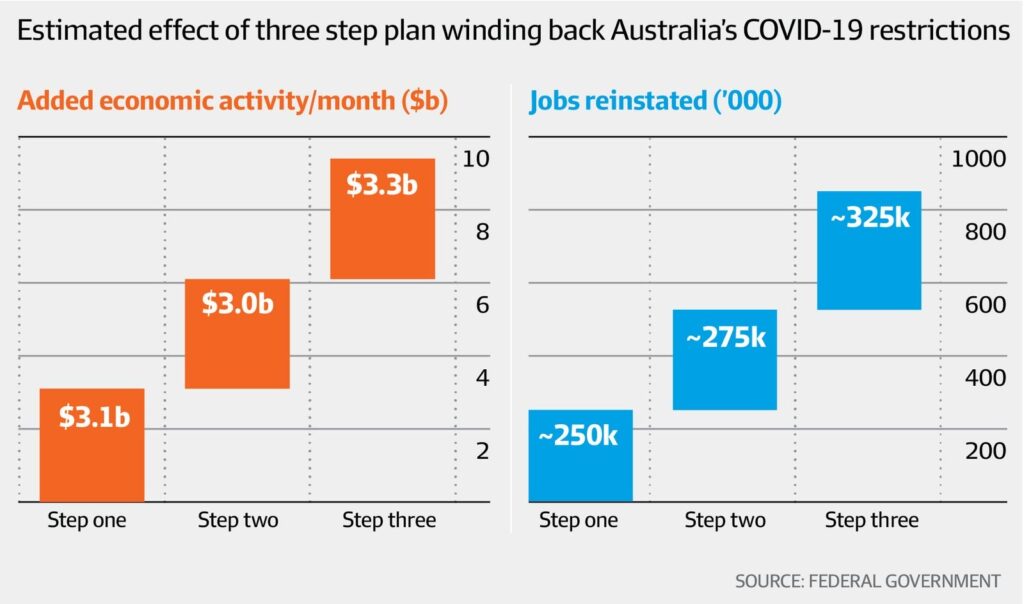

Govt announces 3 stage approach to July reopening

On Friday 8th May, The Morrison Government announced a three-stage plan to reopen much of the economy by July, forecast to get 850,000 people back to work.

- Stage one – treasury estimates stage one will create about 250,000 jobs and generate $3.1 billion in economic activity

- Stage two – is forecast to generate 275,000 jobs and $3 billion in economic activity

- Stage three – is forecast to generate about 325,000 jobs and $3.3 billion in activity

This staged approach will see a lifting of lockdown restrictions earlier than first expected and is a welcome announcement to many hard hit industries.

SEEK Job postings

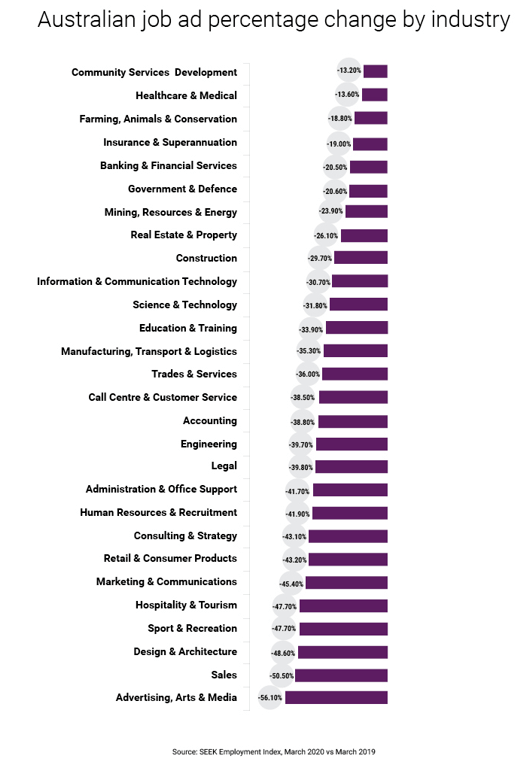

Regarding job ad postings, SEEK reported a 6.4% drop in February, 7.4% decrease in March, and a huge fall in April down 33.9% year on year. SEEK’s April Employment Report showed the industries with the greatest contribution to overall job ad decline year-on-year were Hospitality & Tourism (-47.7%), Trades & Services (-36%) and Information & Communication Technology (-30.7%).

Whilst there has been significant hiring decline within hospitality and tourism sectors, other sectors including healthcare and medical and community services and development, although still in decline, have been more resilient. Roles in disability and aged care have also been less effected as some organisations increase their contingent workforce in response to the health crisis.

Source: seek.com.au

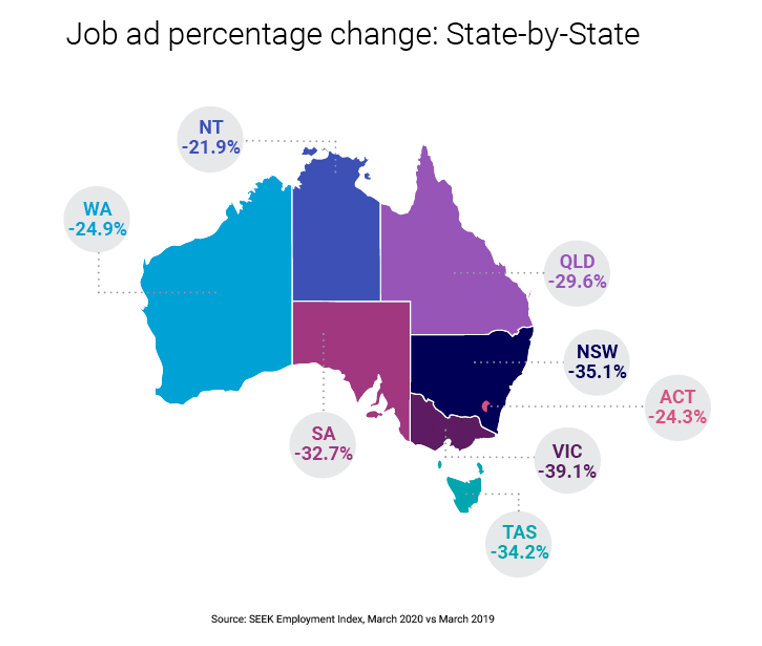

At a state level, SEEK’s data showed job ad volumes have decreased in every state and territory. The top three states contributing to the nation’s overall decline in job ads include NSW (-35.1% y/y), VIC (-39.1% y/y) and QLD (-29.6%).

Source: seek.com.au

Local Update

Based on our own data, we have recoded a large decline in advertised roles locally. However as per the national and state data we have also seen pockets of activity, especially within disability, aged care, health, finance and accountancy and IT.

Disability support workers, personal carers, registered nurses, delivery drivers and customer care consultants for call centres have been in-high demand.

We know through conversations with hundreds of our local clients, CEOs, executives and hiring managers, that many companies put hiring plans on hold in mid-to-late March. Their focus, rightly so, has been on the health and safety of their employees, contractors and customers.

Navigating work-from-home arrangements, COVID-19 safe practices, contingency plans and virtual collaboration has been top-of-mind as companies and the community prepared for the worst, as cases in NSW and Australia surged in late March.

As the state of COVID-19 in Australia has become better controlled and contained over the past couple of weeks we have seen a positive upturn in the Hunter’s job market with some sectors returning to almost full capacity.

As we look towards recovery, and progressive reopening of the economy, Newcastle and the greater Hunter region is well placed. Much of our prominent industry is resilient, including community services, construction, healthcare, mining, logistics, utilities, resources, finance and banking and food and agriculture. As are local emerging industries including advanced manufacturing, defence, medical technology and pharmaceuticals.

Now we have past what seems to be the worst of the crisis, we anticipate business confidence to rise, employment plans to resume and new jobs to be created.

Keep an eye on the GWG blog for more tips on navigating the new business world we live in. And if you need assistance with recruitment or outplacement, don’t hesitate to get in touch to find out how we can help.